- Tape

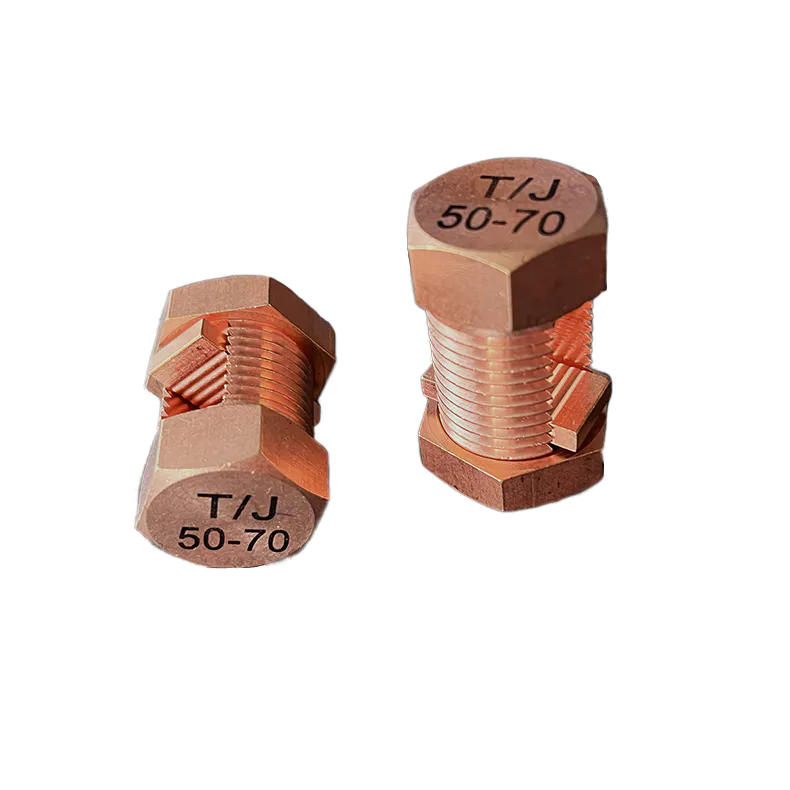

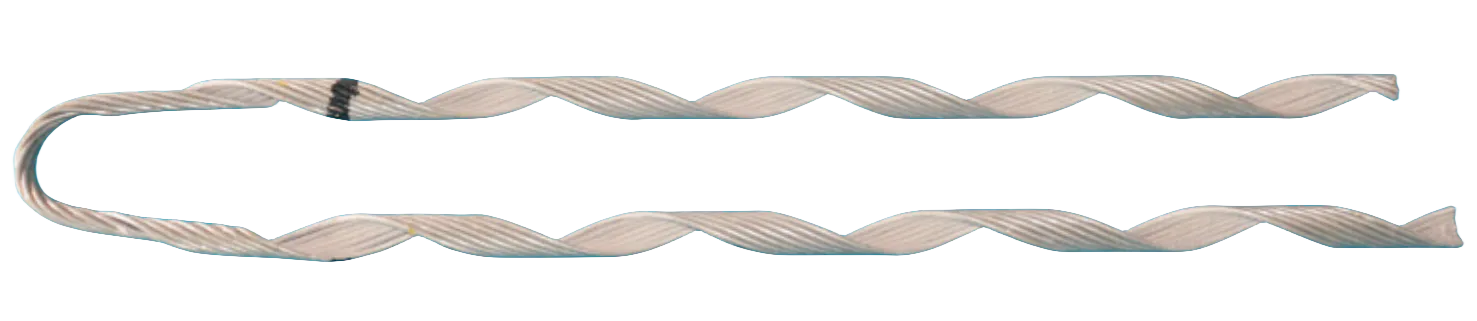

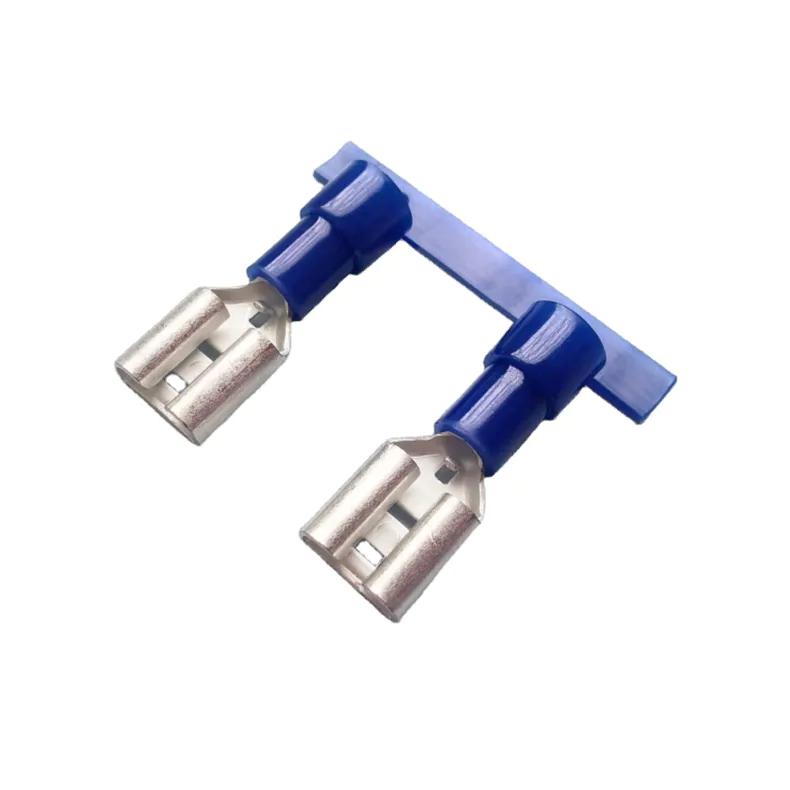

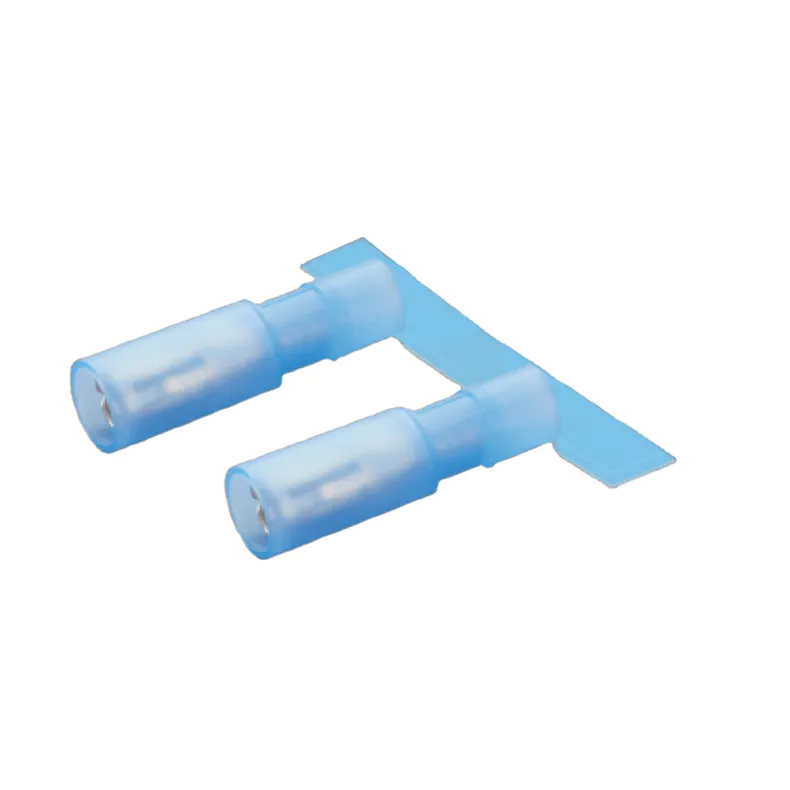

- Terminals & connetors

- Cable Lug

- Terminal block

- Cable tie

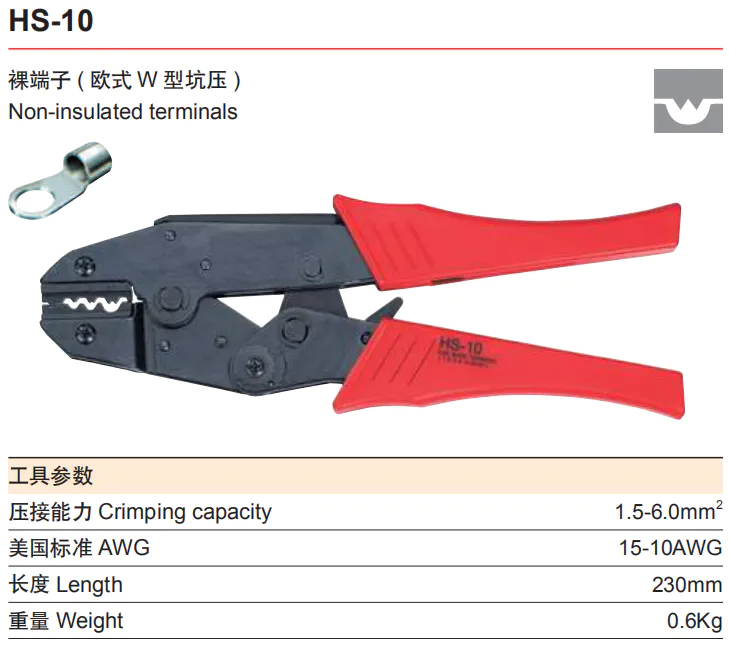

- Crimping tool

- Heat shrinkable tube

- Cable marker

- Junction box

- Cable gland

- Corrugated hose & spiral wrap band

- Wire duct

- Din rail

- Cable clips & mount

- Signal light

- Push button switch

- Standoff insulator

- Pet braided sleeve

- Industrial plug & socket

- Auto fuse

- Others

nickel prices under pressure from vanishing deficits

The rapid growth of nickel supply and the slowdown in demand for stainless steel mills are dragging down metal prices, which may face further pressure this year as the deficit disappears.

The reason for the weak demand in the stainless steel industry, accounting for 70% of global nickel consumption, is estimated to be 2.

Production this year was 4 million tons, including a backlog of stainless steel from producers earlier in 2019.

The trade dispute between the US and China, the world\'s two largest economies, and its potential to disrupt growth and demand are also a major impact.

The benchmark nickel price on the London Metal Exchange was $11,800 a tonne, down 25% in the past 12 months.

Nickel premium: tmsnrt.

Production of nickel cast iron in China: tmsnrt.

Rs/2X8s7T8 nickel inventory: tmsmrt.

Market balance: tmsnrt.

Nickel production in Indonesia: tmsnrt.

Price of nickel and stainless steel: tmsnrt.

Rs/2X8eZ0q \"The market will be basically balanced this year --

Without huge deficits to help prices, the trade war is hanging over the market.

Andrew Mitchell, an analyst at Wood Mackenzie, said: \"Our average income this year is about $12,300 . \"

In 2018, the average price of LME nickel was more than $13,000 per ton.

\"Stainless steel demand is not particularly strong,\" Mitchell said . \".

\"China has implemented the-

Anti-dumping duties on imported stainless steel, Indonesian producers are looking for other markets.

China is the largest stainless steel producer in the world.

In China, a temporary-

Dumping of stainless steel products in Indonesia, the European Union, Japan and South Korea.

Analysts expect China\'s stainless steel production to decline in the coming months as steel mills overstock and prices slide, while nickel cast iron (NPI)

Supply climbed rapidly.

\"NPI production in China and Indonesia will grow by more than 20% this year to reach more than 900,000 tons,\" said Jim Lennon, general manager of Hongmen research.

\"NPI production will grow by about 200,000 tons worldwide.

We think this year\'s deficit will increase from 50,000 tons last year to 150,000 tons.

\"The deficit usually means attracting stocks, which has been falling for more than two years. Stocks in LME-

The approved warehouse was 164,000 tons, compared to 380,000 tons in November 2017.

The nickel inventory in the warehouse monitored by the Shanghai Futures Exchange was about 9,000 tons, the fifth level in January 2018.

\"Some of these metals are restraining orders (

Not in exchange warehouse).

\"The stock numbers do not show a completely accurate picture,\" said a nickel trader . \".

\"The physical market premium tells a more realistic story.

\"The nickel premium in the spot market is higher than the LME benchmark price, and since the beginning of the year, China\'s nickel premium has been hovering around $235 per ton, while European prices have been falling since April, about $225 per ton.

Prices will have to rise in the long run to inspire new projects and capacity to meet the surge in demand for electricity

Some expect an upward trend in the automotive battery industry from next year.

\"New applications, especially electric car batteries that require higher purity nickel, are changing the face of the market,\" said Roskill analyst Thomas Hoehne-sparborth . \".

\"You need a higher price to build capacity.