- Tape

- Terminals & connetors

- Cable Lug

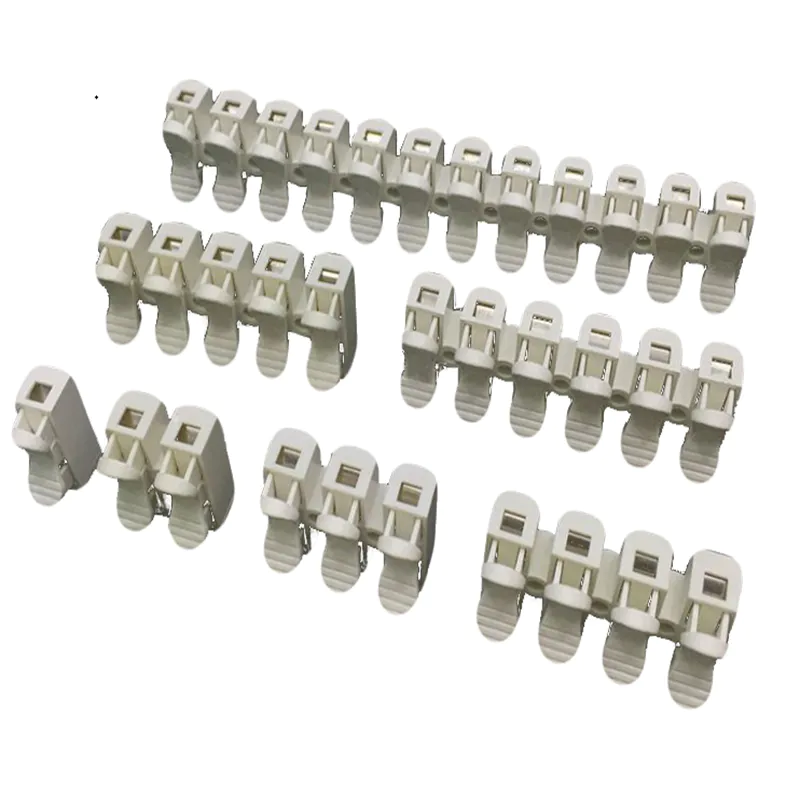

- Terminal block

- Cable tie

- Crimping tool

- Heat shrinkable tube

- Cable marker

- Junction box

- Cable gland

- Corrugated hose & spiral wrap band

- Wire duct

- Din rail

- Cable clips & mount

- Signal light

- Push button switch

- Standoff insulator

- Pet braided sleeve

- Industrial plug & socket

- Auto fuse

- Others

Nickel is dancing to a new electric (vehicle) beat: Andy Home

The opinion expressed here is the opinion of the columnist of Reuters. )

The world used almost 2.

There were 2 million tons of nickel last year.

About 2 out of 3 of the metal is absorbed by the stainless steel industry, which uses it as a key alloy agent.

Stainless steel production is booming.

Global output increased by 5.

At 8% last year, nine more accelerated.

According to the International Stainless Steel Forum, 5% in 2018.

This is good news for nickel.

International Nickel research group (INSG)

Estimated first in the world

The use of nickel jumped by 7.

It was 8% last year, nine others.

There were 7% people in the first five months of this year.

This is the basic bond between nickel and stainless steel, and nickel dances with the adjustment of its largest user base.

Or at least it used to be.

The nickel market may be changing.

Nornickel results for the second quarter show a chart of price correlation between Nickel, stainless steel and cobalt in: tmsnrt

According to Norilsk nickel of Russia, the world\'s largest producer of nickel, the historical price correlation between nickel and stainless steel has broken down.

Nickel has been attracted by wider metal sales.

But this is the only base metal on the London Metal Exchange that is still in the current year --to-

Date territory rose 4% to $13,120 a tonne.

It was also significantly eliminated.

Since the fourth quarter of last year, the performance of stainless steel has opened a growing gap between the two.

Nornickel believes that if nickel is currently related to anything, it is cobalt.

Nickel and Cobalt are the two metals that are expected to benefit the most from electric vehicles (EV)revolution.

Both of these are key inputs for most types of lithium. ion battery.

It seems too early for nickel to replace the pricing partner.

After all, the amount of metal currently used to make batteries is small.

Wood Mackenzie\'s analysts estimate that in 2016, about 40,000 tons of nickel entered the manufacturing of electric vehicle batteries, accounting for less than 2% of the metal used in the current year.

Nickel may have a bright future, but WoodMac and almost everyone else think it will take a few years for the electric vehicle demand accelerator to actually go into use.

However, the market is pre-

The future growth curve and the complex supply chain of nickel began to adapt accordingly.

Global nickel exchange stock chart: tmsnrt.

The Daily leads that are changing in the Rs/2 vMpAPL nickel market are presented in the form of LME stock reports.

Today\'s data show that another 384 tons of nickel were loaded in the exchange warehouse.

LME inventory has declined for 11 consecutive months.

At present, the inventory is 248,328 tons, which is at the level of the end of 2013.

Nickel stocks held by Shanghai Futures Exchange (ShFE)

There\'s the danger of completely disappearing.

Two years ago, in August 2016, there were more than 110,000 tons of goods in ShFE\'s warehouse.

Only 18,844 tons by Friday.

The stock exchange\'s inventory fell by 45%, or 233,000 tons, from its peak of 500,000 tons in early 2016.

Even taking into account the demand for nickel from stainless steel boosters, the scale of the decline exceeds the scope of easy explanation.

Nornickel\'s view is that the battery supply chain is in the process of establishing a pre-

Pre-emptive stocks, traders and investors are also highlighting the process.

The reason the two exchanges are so hard hit is that they all have the \"right\" nickel type to make batteries.

Stainless steel factory can use a variety of forms of nickel.

Whether it\'s nickel-iron, nickel-iron or refined metal, it melts in stainless steelmaking process. Battery-

However, the manufacturer needs nickel sulfate, which can only be manufactured from class I materials at least at present, defined as nickel content greater than 99. 9 percent.

It is the kind of nickel registered in LME and ShFE.

It is the kind of nickel that is short of supply.

Nornickel expects global nickel production to grow by 9% this year, but most of the additional units will be in the form of nickel and iron (NPI)

All of this is destined to be a stainless steel melting shop.

By contrast, production of class I nickel is expected to drop to 19,000 tons this year.

Different trends are directly related. Higher-

Premium nickel producers are still suffering from a price slump caused by a surge in NPI production in China.

A year ago, the price of LME nickel was lower than $10,000 per ton, and producers such as Brazil\'s Vale (Vale) remained focused on operating profits rather than maximizing production. Vale’s first-

Half of the production of 125,000 tons fell 9% from the same period last year.

In addition, the rich NPI and low price environment in 2015

2017 of people have killed investment in new mines in order to produce \"suitable\" nickel.

From this basic point of view, the bullish departure of nickel from stainless steel reflects the price incentive required to stimulate the production of more class I products.

There are signs that the market signals are working.

BHP Billiton failed to sell its Australian nickel business in 2014.

Now, the company is putting money into its assets and investing in a nickel sulfate plant in Perth. Privately-

Dundas mining plans to explore the Avebury mine in tazhou.

The last operation was in 2009.

The expected growth in demand for electric vehicle batteries has driven the rise in nickel prices, which in turn has triggered a recovery in the production of \"suitable\" metals converted into sulfuric acid. Good so far.

But the whole process has accelerated as players have seized physical units and expressed their bullish price views on the London and Shanghai exchanges.

Although some speculative bubbles have been blown off in the past few weeks, there is still a \"power premium\" for nickel prices \".

The problem is that if the escalation of trade tensions does start to affect global growth, the stainless steel industry is likely to become one of the casualties.

This still means trouble for the nickel market.

Nickel may dance with the new beat, but it may find it difficult to break up with a traditional stainless steel partner.